The ISB Placements for PGP Class of 2025 were a remarkable success, further solidifying ISB’s reputation as a premier business school.

The season saw 1164 job offers from 364 companies, including 44 international offers and participation from 60+ first-time recruiters, underscoring ISB’s growing global reach and industry trust.

While the average package for the Class of 2025 is yet to be released, the previous cohort (PGP Class of 2024) recorded an impressive average CTC of INR 35 lakhs, reflecting ISB’s strong compensation benchmarks.

In this article, we provide a detailed breakdown of ISB placement highlights, sector-wise trends, salary insights, and top recruiters from the most recent placement season.

ISB Placements: Key Highlights for PGP Class of 2025

- 44 international offers were made across diverse geographies.

- Over 60 first-time recruiters participated in campus placements.

- Top Recruiting Domains: Consulting, Technology, General Management, Sales & Marketing, Finance, and Supply Chain & Operations.

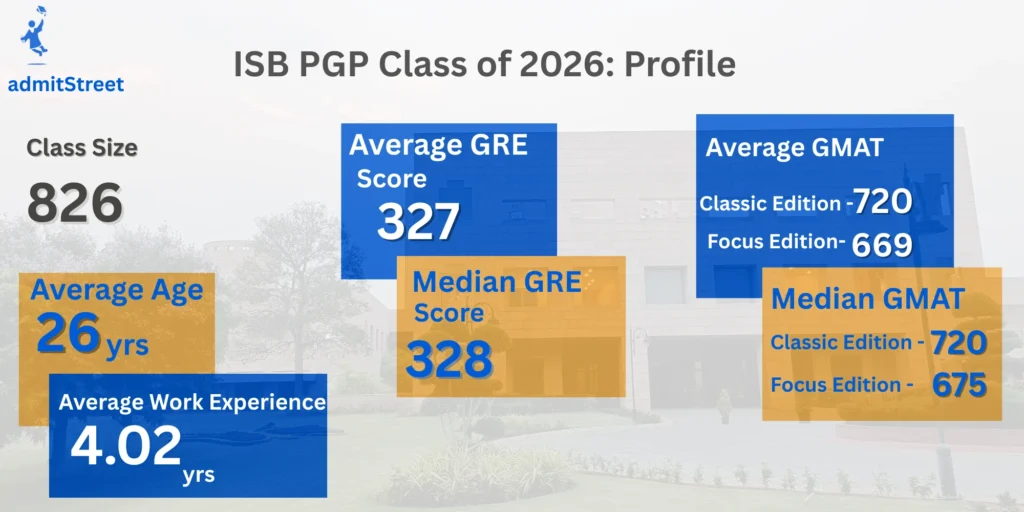

ISB PGP Class of 2026

ISB Placements Data Summary

| Placement Statistics | 2025 Figures |

|---|---|

| Total Registered Companies | 364 |

| Total Job Offers | 1164 |

| Average CTC (80% Range) | NA |

| International Offers | 44 |

Curious how applicants have navigated the ISB application journey? Read how Arnab cracked ISB with a 675 GMAT.

ISB Placements:

Now Lets take a look for the latest placement trends Industry wise & function wise sequentially :

Industry-Wise Offers

| Industry | Offers (%) 2025 |

|---|---|

| Advt/Media/Comm/PR/Entertainment | 3% |

| BFSI (Banking, Financial Services and Insurance) | 11% |

| Consulting and Professional/Advisory Services | 37% |

| Education/Teaching and Training | 1% |

| Energy | 1% |

| FMCG/Retail/Consumer Durables/E-commerce/Agri | 5% |

| Govt/PSUs/NGO/Forces/Services/Multilateral Orgs. | 2% |

| Infrastructure/Construction/Real Estate | 1% |

| Manufacturing | 2% |

| Pharma/Biotech/Healthcare/Hospitals | 2% |

| Technology | 28% |

| Transportation/Logistics | 1% |

Observations and Inferences:

- Consulting & Advisory Services (37%)

- Largest share of offers in 2025.

- Strong demand for strategy, digital transformation, and advisory roles.

- Reaffirms ISB’s reputation as a top consulting talent hub.

- Technology (28%)

- Second-highest recruiter of ISB graduates.

- Key roles in product management, data analytics, AI, and cloud.

- Reflects the rapid growth of digital-first careers.

- BFSI – Banking & Financial Services (11%)

- Consistent presence in ISB placements.

- Roles in investment banking, fintech, private equity, and corporate finance.

- Mix of traditional and new-age financial institutions hiring.

- FMCG, Retail, E-commerce & Agri (5%)

- Stable recruiter across years.

- Opportunities in brand management, marketing, and supply chain leadership.

- Growing demand from e-commerce players.

- Pharma, Biotech & Healthcare (2%)

- Niche but steady opportunities.

- Roles in healthcare consulting, pharma strategy, and biotech innovation.

- Increasing relevance post-pandemic.

- Manufacturing (2%)

- Focus on leadership and specialized roles.

- Opportunities in operations, supply chain, and industrial strategy.

- Govt/PSUs/NGOs/Multilaterals (2%)

- Impact-driven career paths.

- Roles in policy, governance, and development sectors.

- Conglomerates / Diversified Businesses (3%)

- Attract ISB graduates for cross-functional leadership roles.

- Strong demand from large multi-sector corporations.

- Media, Communication & Entertainment (3%)

- Careers in corporate communication, PR, and digital media.

- Steady yet niche sector presence.

- Education & Training (1%)

- Limited but strategic leadership opportunities.

- Typically for roles in academic management and policy.

- Energy (1%)

- Focused on renewables, sustainability, and traditional energy roles.

- Small share but critical for long-term industry relevance.

- Infrastructure, Real Estate & Construction (1%)

- Selective hiring for project leadership and strategic roles.

- Transportation & Logistics (1%)

- Specialized roles in logistics optimization and supply chain.

Function-Wise Offers

Here is the combined table for Function-wise Offers Data for 2025 :

| Function Segment | Offers (%) Co’ 25 |

|---|---|

| Business/Strategy Consulting | 21% |

| IT/Technology Consulting | 11% |

| Investment Advisory | 10% |

| General Finance | 9% |

| Analytics & Data Science | 9% |

| Operations | 8% |

| Business Strategy | 8% |

| Product Management (Technology) | 8% |

| General Management | 5% |

| Program Management (Tech) & Transformation | 3% |

| Category & Product Management | 3% |

| Digital & Growth Marketing | 2% |

| Brand Marketing | 2% |

| Sales Management | 2% |

Observations and Inferences:

- Consulting Dominates

- Business/Strategy Consulting led with 21% of offers, reaffirming ISB’s reputation as a consulting talent hub.

- IT/Technology Consulting added another 11% of offers, showing rising demand for ISB graduates in digital transformation roles.

- Finance Roles Stay Steady

- Investment Advisory (10%) and General Finance (9%) attracted significant interest, with opportunities across investment banking, private equity, and corporate finance.

- Technology & Analytics Gain Traction

- Analytics & Data Science accounted for 9% of offers, reflecting the growing importance of data-driven decision making.

- Product Management (Tech) saw 7% of offers, highlighting ISB’s alignment with fast-growing technology roles.

- General Management & Strategy

- Business Strategy (9%) and Operations (8%) remained strong, often offered via leadership development programs at top firms.

- Marketing & Sales as Niche Areas

- Sales Management accounted for just 2% of offers, showing lower student interest compared to consulting, finance, and technology.

- Brand Marketing (3%) and Digital & Growth Marketing (2%) offered select but valuable opportunities.

This data highlights the dominant sectors and functions driving ISB placements, with Consulting and Technology leading the way, followed by strong opportunities in Finance, General Management, Product Management, and Marketing.

ISB Placements : Compensation (CTC)

ISB has not released official compensation (CTC) data beyond the Class of 2023. However, here is the industry-wise and function-wise breakup of the available compensation figures:

Industry-Wise Compensation : Class of 2023

| Industry | Mid 80% average CTC Co’ 23 (INR) 2023 | 80% CTC Range (INR)2023 |

|---|---|---|

| Advt/Media/Comm/PR/Entertainment | 3,212,444 | 24.5 – 40 |

| BFSI (Banking, Financial Services and Insurance) | 3,096,269 | 23.8 – 46 |

| Consulting and Professional/Advisory Services | 3,557,509 | 26.4 – 45 |

| Education/Teaching and Training | 4,333,333 | 35.0 – 60 |

| Energy | N/A | N/A |

| FMCG/Retail/Consumer Durables/E-commerce/Agri | 3,288,207 | 27.7 – 40 |

| Govt/PSUs/NGO/Forces/Services/Multilateral Orgs. | 3,288,889 | 18.0 – 40 |

| Infrastructure/Construction/Real Estate | 3,000,000 | 28.0 – 35 |

| Manufacturing | 4,883,400 | 24.0 – 66 |

| Pharma/Biotech/Healthcare/Hospitals | 3,703,889 | 24.5 – 45 |

| Technology | 3,286,100 | 25.0 – 42 |

| Transportation/Logistics | 2,993,213 | 23.0 – 38 |

| Conglomerates/ Diversified | 2,850,000 | 26.1 – 30 |

Function-Wise Compensation – 2023

| Function Segment | Mid 80% average CTC Co’ 23 (INR) | 80% CTC Range (INR) |

|---|---|---|

| Business/Strategy Consulting | 36,64,800 | 27.2 – 45 |

| Finance | 29,72,614 | 24.7 – 40 |

| Operations | 33,35,048 | 27.0 – 44 |

| Sales & Marketing | 32,89,290 | 25.9 – 55 |

| Technology | 36,04,211 | 28.0 – 45 |

| Others | 28,96,514 | 20.0 – 36 |

| General Management/Leadership | 30,31,538 | 24.0 – 37 |

| Human Resources | 24,00,000 | 24.0 – 24 |

| Analytics | 34,30,148 | 26.4 – 55 |

| Business Research | 33,50,000 | 23.0 – 39 |

| Product Management | 34,00,022 | 25.0 – 45 |

| Project Management | 28,84,514 | 26.2 – 32 |

Year-on-Year Trends in ISB Placements

| Year | Class Size | Registered Companies | Job Offers | Mean CTC (INR) | Median CTC (INR) |

|---|---|---|---|---|---|

| 2025 | 816 | 364 | 1164 | NA | NA |

| 2024 | 870 | 405 | 1208 | 35,00,000 | NA |

| 2023 | 845 | 324 | 1609 | 33,25,742 | 32,00,000 |

| 2022 | 929 | 393 | 2072 | 32,76,366 | 31,00,000 |

| 2021 | 690 | 308 | 1195 | 27,13,055 | 27,00,000 |

| 2020 | 890 | 433 | 1504 | 25,06,850 | 24,10,000 |

| 2019 | 884 | 373 | 1309 | 24,35,915 | 24,02,449 |

Observations and Inferences

- Sustained Salary Growth: The average CTC for PGP Co’ 24 continued to rise, reaching INR 35 lakhs, demonstrating consistent value addition by ISB in developing student capabilities.

- Fluctuations in Companies and Offers: While the number of registered companies and job offers has varied year to year, the quality of placements remained strong, with high average and median salaries. For example, offers peaked at 2,072 in 2022, but still held strong in 2024 despite fewer recruiters.

- International Opportunities: The presence of international offers (44) indicates ISB’s growing global footprint and the relevance of its graduates in foreign markets.

Govind’s comeback is proof that reapplicants can crack ISB – by reflecting on past gaps, elevating their GMAT score, amplifying impact at work, and crafting a more compelling, authentic narrative.

Top Recruiters at ISB

Here is a list of top recruiters from ISB’s PGP Co’ 25 placement season:

- McKinsey & Company

- Boston Consulting Group (BCG)

- Bain & Company

- Amazon

- Deloitte

- Goldman Sachs

- Accenture

- Cognizant

- KPMG

- EY (Ernst & Young)

- Barclays

- PricewaterhouseCoopers (PwC)

- Microsoft

- Flipkart

- Procter & Gamble (P&G)

- ICICI Bank

- HDFC Bank

- Aditya Birla Group

- Tata Group

- Hindustan Unilever Limited (HUL)

- Axis Bank

- Infosys

- Walmart Global Tech

- Pharmaceuticals and Healthcare Companies (like Dr. Reddy’s and Pfizer)

These companies span across consulting, technology, financial services, e-commerce, FMCG, and manufacturing sectors, showcasing the diverse opportunities ISB students have for placements.

More on ISB

Looking for deeper insights into ISB admissions & placements? Explore these guides:

Final Thoughts

The ISB Placements for PGP Co’ 25 showcase the school’s ability to attract top recruiters from diverse industries, offering its graduates lucrative domestic and international opportunities. With a strong showing in sectors like Technology, Finance, and Consulting. ISB maintains its position as a leading business school for global talent. The ISB average package reflects consistent growth, making it a top choice for aspiring leaders aiming for impactful careers across the globe. As ISB continues to expand its network of recruiters and alumni, the future looks bright for its graduates.

Dreaming of ISB?

Work with our ISB-experienced mentor to craft winning essays, LORs, and interview prep.

FAQs – ISB Placements

What is the average package offered at ISB for the PGP Co’ 24?

The average package (CTC) offered at ISB for the PGP Co’ 24 is INR 35.00 lakhs.

Which sectors made the most offers during ISB Placements 2025?

The Consulting & Professional/Advisory Services sector led the offers with 37%, followed by Technology with 28%, and BFSI (Banking, Financial Services, Insurance) with 11%.

How many international offers were made during ISB Placements 2025?

International placements remained robust, with 44 offers across regions such as Southeast Asia, the Middle East, and Africa, providing valuable exposure to global business environments.

What are the top recruiting domains at ISB?

The top recruiting domains at ISB for PGP Co’ 25 were Consulting, Technology, General Management, Sales & Marketing, Finance, and FMCG/Retail.

How many companies participated in ISB Placements 2025?

A total of 364 companies registered for campus placements, offering 1164 job opportunities to the PGP Co’ 25 students.

What is the average GMAT score of ISB’s PGP Co’ 25?

The average GMAT score for the PGP Co’ 25 batch at ISB was 719.