In today’s dynamic financial landscape, a Master’s in Finance (MiF) is more than just a degree; it’s a gateway to high-level careers in banking, investment, consulting, and corporate finance.

Selecting the right program can significantly impact your career trajectory, providing advanced knowledge and skills, valuable industry connections, and impressive earning potential.

This article highlights ten top 10 Masters in Finance programs from prestigious business schools worldwide, each renowned for its academic excellence, robust curricula, and strong placement records.

Top 10 Master in Finance (MiF) Programs

| # | School Name | MiF Program Name | Location (main campus) | Duration | Salary today (US$) | Salary percentage increase |

| 1 | HEC Paris | MSc International Finance | France | 10 months | 175,703 | 120 |

| 2 | London Business School | Masters in Finance | UK | 10-16 months | 135,158 | 57 |

| 3 | Essec Business School | MSc Finance | France | 12 months | 135,371 | 71 |

| 4 | ESCP Business School | MSc Finance | France | 15 months | 158,176 | 63 |

| 5 | University of Oxford: Saïd | MSc Financial Economics | UK | 9 months | 142,556 | 54 |

| 6 | Imperial College Business School | MSc Finance | UK | 12 months | 129,354 | 69 |

| 7 | IE Business School | Master in Finance | Spain | 12 months | 148,414 | 78 |

| 8 | University of St Gallen | Master of Arts in Banking and Finance (MBF) | Switzerland | 18 months | 141,526 | 74 |

| 9 | Edhec Business School | MSc in International Finance | France | 12 months | 129,706 | 70 |

| 10 | SDA Bocconi/Università Bocconi | Master in Corporate Finance (MCF) | Italy | 12 months | 125,432 | 75 |

HEC Paris

HEC Paris’s Master in International Finance (MIF) program is globally renowned, ranked #1 by QS Rankings in 2024. Designed to prepare students for high-impact careers in finance, this program boasts impressive outcomes, including a 100% employment rate within three months of graduation and competitive salaries.

Key Facts

| Metric | Value |

| Program Name | Master in International Finance |

| Ranking | #1 QS Rankings 2024 |

| Employment Rate (3 months) | 100% (Financial Times 2023) |

| Median GMAT | 710 |

| Average Starting Salary | €78,000 |

| Average Salary (3 years post-grad) | €157,000 |

| International Students | 63% |

| Duration | 10 months |

Program Structure

HEC Paris’s MIF program offers two tracks to cater to different academic backgrounds:

- Business Track

- Accelerated Track

Business Track

For students with a background in business and finance, typically including courses in financial accounting, corporate finance, financial markets, derivatives, and statistics. These students often have internship experience in banking or consulting.

Accelerated Track

Designed for students with strong quantitative skills, often from fields such as mathematics, physics, engineering, or econometrics, looking to transition into finance. This track is also suitable for students with humanities backgrounds without prior finance coursework or internships.

Curriculum

The MIF program starts with a tailored 7-week sequence based on the student’s academic background, followed by core and advanced courses in the first semester and a wide range of electives in the second semester.

Core Courses

- Asset Management

- Behavioral and Sustainable Finance

- Corporate Finance

- Corporate Valuation

- Economics of Financial Regulation

- Ethics Seminar

- Financial Accounting and Reporting

- Financial Modelling

- Financial Statement Analysis

- Fixed Income and Money Markets

- International Finance

- International Macroeconomics

- Introduction to Finance

- Securities Markets

Specializations

Students choose one of two specializations as part of their application:

- Corporate Finance Specialization: Ideal for careers in M&A, private equity, consulting, and multinational corporations.

- Capital Markets Specialization: Suited for careers in trading, structuring, market analysis, wealth, and asset management.

Specialization Courses

| Corporate Finance Specialization Courses | Capital Markets Specialization Courses |

| Corporate Restructuring | Empirical Methods in Finance |

| Derivatives | Financial Engineering |

| Financial Modeling | Quantitative Asset Management |

Career Outcomes

HEC Paris’s MIF graduates have exceptional career prospects, reflected in their high employment rates and salaries.

Employment Statistics

| Metric | Percentage |

| Employment within 3 months | 100% |

| Average Starting Salary | €78,000 |

| Average Salary (3 years post-grad) | €157,000 |

Post-Master Job Functions

| Function | Percentage |

| Consulting | 12% |

| General Management | 4% |

| Finance | 84% |

Post-Master Job Sectors

| Sector | Percentage |

| Consulting | 13% |

| Real Estate | 3% |

| Other | 6% |

| Financial Services | 78% |

Admissions

HEC Paris values applicants with strong quantitative backgrounds and welcomes candidates from all nationalities.

Eligibility

Business Track:

- Bachelor’s or Master’s degree from an international institution

- Prior coursework in financial accounting, corporate finance, investments, derivatives, business statistics, and calculus

Accelerated Track:

- Bachelor’s or Master’s degree from an international institution or a master’s degree from a French university or engineering school

Application Process

Phase 1:

- Online application and submission of supporting documents

Phase 2:

- Face-to-face or Zoom interview for pre-selected candidates

Required Documents

- Degree certificate(s)

- Academic transcripts

- Résumé (CV)

- GMAT/GRE/TageMage scores

- English language proficiency test score (if applicable)

- Two reference forms

- Passport-style photo

- Application fee of €125

Fees and Living Costs

| Academic Year | Academic Fees | Student Services Fees | Administrative Fees | Total Tuition Fees |

| 2024/2025 | €40,900 | €1,950 | €950 | €43,800 |

Additional living costs are approximately €1,000 per month, covering housing, food, insurance, sports, and leisure activities.

London Business School

London Business School (LBS) offers a prestigious Master in Finance (MiF) program designed to provide deep financial expertise and advanced practical skills. Here, we provide a comprehensive overview of the program, including its structure, career prospects, admissions process, and costs.

Program Overview

- Duration: 10-16 months

- Next Start: August 2024

- Format: Full-time

- Location: London

- Student Association Fee: £180

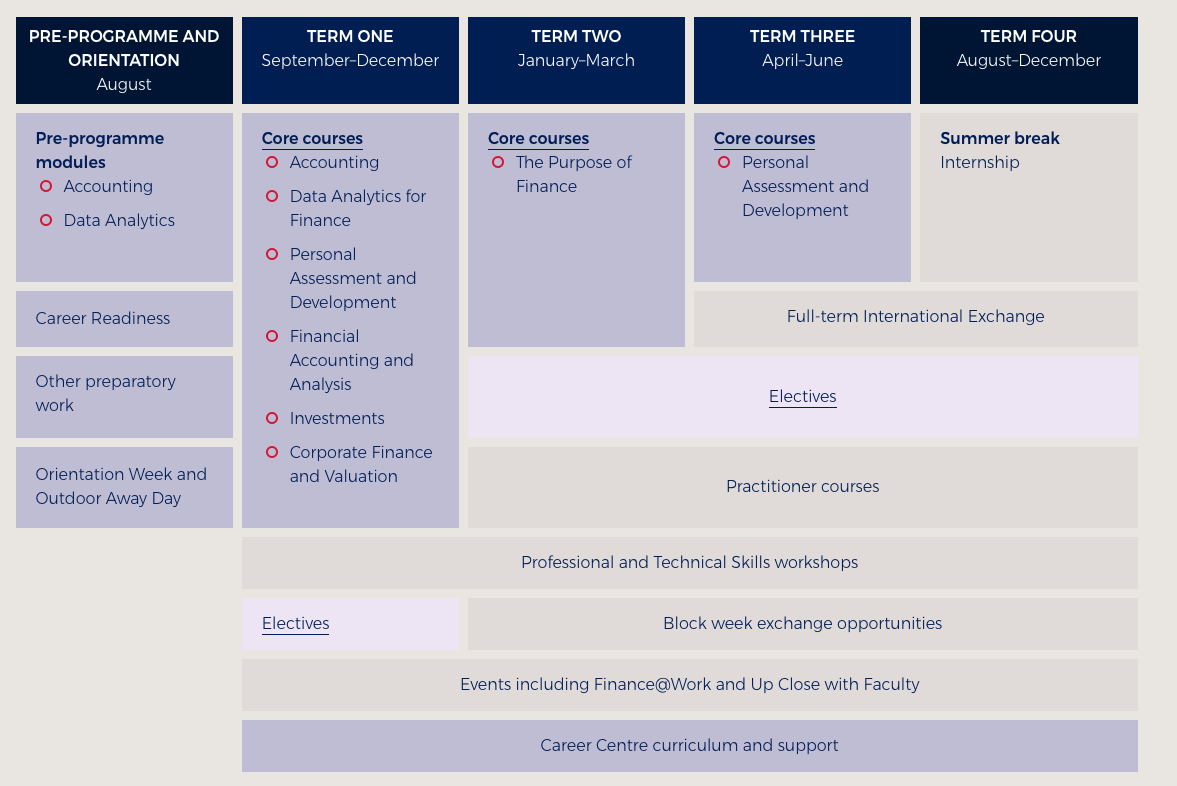

Program Structure

The MiF program at LBS is highly flexible, allowing students to tailor their studies to their career goals and interests through a wide range of electives and concentrations.

- Electives Portfolio: Over 65 electives, more than any other MiF program.

- Specializations: CFO, Corporate Finance, Investment Management and Analysis, Risk Management and Derivatives.

- Flexible Exit Points: Supports career development with various completion timelines.

- Fourth Term Options: International exchange, internship, or additional electives.

Core Areas of Study

- Investments

- Corporate Finance and Valuation

- Financial Accounting and Analysis

- Purpose of Finance: Reflecting on industry experience and the finance profession

Practical Experience

- Real-world project work to apply learning

- Discussions with established finance leaders

- Global Immersion Elective: Visiting major banking and asset management firms abroad (recent locations include New York/Boston and Paris/Frankfurt)

Career Outcomes

LBS’s MiF graduates enjoy exceptional career prospects with strong employment rates and competitive salaries.

Employment Statistics:

| Metric | Percentage |

| Accepted an offer within 3 months | 90% |

| Received an offer within 3 months | 93% |

| Reporting rate | 99% |

Sector Breakdown (2022):

| Sector | Percentage |

| Financial Services | 78% |

| – Investment Banking | 33% |

| – Investment Management | 16% |

| – Central Banks/Ministries/Regulation | 12% |

| – Private Equity | 10% |

| – Venture Capital | 4% |

| – Retail Banking | 2% |

| – Insurance and Pension Services | 1% |

| Non-finance | 22% |

| – Diversified | 12% |

| – Technology | 5% |

| – Consulting | 5% |

Salary Information:

| Sector | UK Pounds | US Dollars | International Dollars |

| Mean | £80,494 | $97,725 | $117,117 |

| Min | £24,000 | $29,621 | $31,086 |

| Max | £155,405 | $185,000 | $252,488 |

| Other Comp. | £50,773 | $61,233 | $80,969 |

| Min | £5,200 | $6,262 | $6,572 |

| Max | £223,967 | $245,559 | $811,138 |

Admissions Process

Application Requirements:

- Completed online application form (can be saved and completed over several sessions)

- Application essays:

- Q1: Career objectives, steps to achieve them, alternatives considered, and preferred geographical work region (max 500 words)

- Q2: Areas of LBS life you are excited about and how you will add value to the school community (max 300 words)

- One-page CV

- Names and details of referee(s)

- GMAT/GMAT Focus/GRE score (waivers available)

- Proof of English language ability (IELTS, TOEFL, Cambridge CPE, CAE, PTE Academic)

- Copy of university transcript(s)

Application Fee: £150 (paid by credit card)

Fees and Funding

Tuition Fees for 2024 Intake: £62,500

Payment Options:

- Full payment at the start of the academic year

- Installment plans available

ESSEC Business School

The Master in Finance (MIF) program at ESSEC Business School is designed to provide students with a comprehensive education in finance, preparing them for successful careers in the global financial industry. With campuses in France (Cergy) and Singapore, the program offers a unique international perspective and is recognized for its excellence, ranking #3 in the Financial Times’ Best Master in Finance rankings for 2023.

Program Details

Program Name: Master in Finance (MIF)

Language: English

Duration:

- 1 year (for students with a 4-year Bachelor’s or Master’s degree)

- 2 years (for students with a 3-year Bachelor’s degree)

Next Intake: August 26, 2024

Locations:

- France (Cergy)

- Singapore

Class Profile

| Metric | Percentage/Number |

| Degrees in Economics, Business, and Finance | 80% |

| Degrees in Engineering and Sciences | 20% |

| Average Age | 23 |

| Women | 30% |

Program Structure

The Master in Finance program at ESSEC Business School emphasizes a global approach to finance, integrating academic rigor with real-world professional experience. The program structure varies depending on the duration of study.

Academic Experience

Duration:

- 2 years (Master 1 + Master 2)

- 1 year (Master 2 only)

Professional Experience

Each year, students complete a 4-6 month internship, which can be done anywhere in the world. An academic dissertation is an alternative option during the second year (M2).

International Experience

Students participate in two study trips to major financial hubs such as London, Hong Kong, or New York.

Curriculum

Master 1 (M1)

| Term | Location | Courses |

| Term 0 | France or Singapore | Preparatory Courses |

| Term 1 | France or Singapore | Core Courses |

| Terms 2 & 3 | – | Internship |

Master 2 (M2)

| Term | Location | Courses |

| Term 0 | France or Singapore | Core Courses |

| Term 1 | France or Singapore | Core & Elective Courses (including AlumnEye Training and inter-campus mobility options) |

| Terms 2 & 3 | France or Singapore | Internship or Academic Dissertation, International Study Trips, Digital Workshop Competition, Job Fairs |

Specializations

Students can choose from three specializations based on their career goals:

| Specialization | Location |

| Corporate Finance | France or Singapore |

| Financial Markets | France or Singapore |

| Fintech & Analytics | Singapore |

Career Outcomes

Graduates of the ESSEC Master in Finance program have excellent career prospects, with many finding jobs even before graduation.

Career Statistics

| Metric | Percentage |

| Found a job before graduation | 68% |

| Found a job within 3 months of graduation | 84% |

| Work outside their country of origin | 48% |

| Hold a permanent contract | 86% |

| Enrolled in a graduate program | 44% |

Employment by Region

| Region | Percentage |

| Europe | 74% |

| Asia | 11% |

| Americas | 3% |

| Rest of the world | 13% |

Employment Sectors

| Sector | Percentage |

| Banking | 48% |

| Consulting | 16% |

| Brokerage/Market Finance | 7% |

| Investment Funds/Financial Holdings | 6% |

| Asset Management | 5% |

| Industry (Energy, Telecom, ICT, etc.) | 18% |

Job Functions

- Asset Management/Portfolio Management

- Capital Investment/Risk Capital

- ECM-DCM

- M&A/Consulting

- Private Equity/Venture Capital

- Project Funding/Structured Financing

- Risk Management

- Sales Structuring

- Trading

- Transaction Services/Financial Analysis/Firm Valuation

Admissions

Eligibility

- 2-Year Program: 3-year Bachelor’s Degree or Licence 3

- 1-Year Program: 4-year Bachelor’s Degree or Master’s Degree

Admissions Process

- Anticipate, prepare, and take the tests

- Start your online application

- Upload your supporting documents

- Submit your application

- Get your results

- Secure your seat

Admissions Calendar

| Round | Application Deadline | Admission Results |

| 1 | October 18, 2023 (Noon Paris Time) | November 24, 2023 |

| 2 | January 4, 2024 (Noon Paris Time) | February 15, 2024 |

| 3 | February 29, 2024 (Noon Paris Time) | April 12, 2024 |

| 4 | April 23, 2024 (Noon Paris Time) | June 7, 2024 |

Program Costs

1-Year Program (M2)

| Category | EU Citizens | Non-EU Citizens |

| Total Tuition | €27,000 | €30,000 |

| Deposit (non-refundable) | €5,000 | €5,000 |

| Remaining Tuition | €22,000 | €25,000 |

| Service Fee | €1,980 | €2,080 |

2-Year Program (M1+M2)

| Year | Category | EU Citizens | Non-EU Citizens |

| M1 | Total Tuition | €13,800 | €13,800 |

| M2 | Total Tuition | €27,000 | €30,000 |

| Both | Deposit (non-refundable) | €5,000 | €5,000 |

| Both | Remaining Tuition | €8,800 (M1), €22,000 (M2) | €8,800 (M1), €25,000 (M2) |

| Both | Service Fee | €2,080 (M1), €2,280 (M2) | €2,280 (M1), €2,280 (M2) |

ESCP Business School

The Master of Science (M.Sc.) in Finance at ESCP Business School stands as a prestigious program tailored for aspiring finance professionals who seek to build a robust foundation in financial markets and investment banking. With campuses in Paris and London, ESCP offers a unique international experience, providing students with unparalleled opportunities to immerse themselves in two of the world’s leading financial centers.

Program Overview

| Program Name | M Sc Finance |

| Entry Level | Bachelor’s degree (minimum 180 ECTS credits) |

| Duration | 15 months (full time) |

| Languages Required | French and English (Available in English for the global track) |

| Specializations | Investment Banking & Financial Markets |

| Campus Locations | ESCP Paris (15 weeks) and ESCP London (15 weeks) |

| Internship & Thesis | Minimum four-month internship and professional thesis |

Career Outcomes

Graduates of the MSc Finance program from ESCP Business School enjoy excellent career prospects, with impressive placement statistics and salaries.

Employment Statistics

| Metric | Percentage |

| Professional Activity within 3 Months | 100% |

| International Dimension Positions | 67% |

Salary Information

| Metric | Amount |

| Average Salary after MSc | €97,000 |

Employment Sectors

| Sector | Percentage |

| Banking | 58% |

| Financial Markets | 26% |

| Others (Consulting, Law, etc.) | 6% |

Typical Job Titles

- Analyst

- Business Analyst

- IB Analyst

- Investment Banking Analyst

- Equity Research Analyst

- M&A Analyst

- Risk Analyst

- Broker

- Trader

- Financial Director

Major Recruiters

Companies frequently hiring graduates include:

- Citi

- Rochefort & Associés

- ING

- UBS Group AG

- JP Morgan

- Bank of America Merrill Lynch

- Lazard

- HIG Capital

- Ardian

- OakleyAdvisory

- Morgan Stanley

- Drake Star Partners

- Société Générale

- Deutsche Bank

- Goldman Sachs

- HSBC

- LGT European Capital

- DC Advisory

- Commerzbank AG

- Rothschild & Co

- RBC Capital Markets

Admission Criteria

Eligibility Requirements:

- Bachelor’s degree or equivalent

- Minimum of 180 ECTS credits

- Proficiency in English and French

Admission Procedure

Step 1: Application File

Documents Required:

- Copy of the last diploma obtained or school certificate for the current diploma

- Transcripts from the last two years of study

- Copy of passport or identity card

- Updated resume

- TOEFL, TOEIC, or IELTS scores (taken within the last two years)

- Passport photo (JPEG format)

- Two letters of recommendation (recommended)

Application Fees:

- €130 (non-refundable)

- €195 for two specializations (non-refundable)

Step 2: Individual Interview

Eligible candidates are invited to an interview with the Scientific Director and industry professionals.

Step 3: Registration Confirmation

Admitted candidates must confirm their registration and pay a non-refundable deposit of €3,000.

Admission Calendar

| Session | Closing of Online Registrations | Eligibility Results | Interviews | Admission Results |

| 1st | Jan 10, 2024 | Jan 23, 2024 | Jan 30 – Feb 1, 2024 | Feb 6, 2024 |

| 2nd | March 29, 2024 | Apr 19, 2024 | Apr 24 – May 10, 2024 | May 13, 2024 |

| 3rd | June 6, 2024 | June 20, 2024 | June 25-27, 2024 | July 2, 2024 |

Tuition Fees (2024/2025 Academic Year)

Total Tuition Fees:

- €29,100

Payment Options:

- Lump sum at the start of the academic year

- Four installments from November to February

Additional Costs:

- Accommodation and transport costs for courses held at ESCP campuses (Berlin, London, Paris, Madrid, Turin, or Venice)

Oxford Saïd Business School

The MSc Financial Economics program at Oxford Saïd Business School is a prestigious, intensive, and comprehensive program designed to propel your career in the financial sector. Starting on 23 September 2024, this nine-month full-time program combines rigorous academic training with real-world applications, preparing graduates for high-level careers in finance and economics.

- Start Date: 23 September 2024

- Duration: 9 months

- Time Commitment: Full time

- Location: Oxford

- Cost: £55,630

Program Details

Programme Overview:

The MSc Financial Economics program is designed to provide students with the knowledge and skills required by the financial sector. Delivered by Saïd Business School faculty in collaboration with the Department of Economics, this intellectually demanding and highly practical program integrates theoretical foundations with practical applications tailored to meet the demands of leading financial recruiters.

Core Courses:

| Course | Description |

| Asset Pricing | Covers theory and practice of valuing claims to uncertain cash flows, including stocks, options, bonds, and foreign exchange instruments. Emphasizes advanced statistical methods and real-world data application. |

| Corporate Finance | Fundamental principles of financial accounting, asset valuation, financial structures, financial markets operations, and financial institutions’ roles. |

| Financial Econometrics | Focuses on empirical modeling and testing in finance, modern financial econometrics techniques, and empirical investigation in financial economics. |

| Economics | Microeconomics and macroeconomics applications to financial and commercial frameworks, including market and firm analysis, game theory, incentive theory, and auctions. |

| Ethics & Finance | Engages students with theory and practice of ethics in finance, involving practitioners and real-world case studies. |

Electives:

Students can choose five electives to tailor their learning experience. One elective can be substituted with an individual project. Below are examples of previously offered electives:

| Elective Course | Description |

| Advanced Econometrics: Forecasting | Methods for forecasting problems in economics and finance, applicable to diverse datasets and problems. |

| Continuous Time Finance | Stochastic calculus applications to pricing and hedging financial contracts like equity options and derivatives. |

| Corporate Valuation | Methods to establish and increase business value, critical for mergers, acquisitions, and private equity transactions. |

| Diversity, Inclusion and Finance | Debates on diversity and inclusion in the workplace, focusing on gender, race, age, and skill diversity. |

| Financial Crises and Risk Management | Understanding financial crises and learning risk management techniques for real-world situations. |

| Financial Markets Trading | Managing risk, investors, market dynamics, and participants. |

| Fixed Income and Derivatives | Analytical tools for understanding and pricing fixed income instruments and derivatives. |

| Fundamental Analysis for Active Investing | Practical applications of financial statement analysis for active investing, case-based and interactive learning. |

| Governance and Ethics | Philosophical and practical discussions on corporate ethics, fraud, diversity, human rights, and professionalism. |

| Identification: Causation vs. Correlation | Techniques to identify causation using tools like randomized control trials (RCTs). |

| Individual Project | Addressing academic or practical issues in financial economics, demonstrating applied financial economics tools. |

| International Finance | Analytical frameworks for macroeconomic performance and capital flows in the global economy. |

| Investing in Private Markets | Asset owner perspective on private markets with a focus on critical thinking and interactive learning. |

| Investing in Public Equity | Asset management topics including diversification, market efficiency, passive and active investing, and ESG factors. |

| Mergers, Acquisitions and Restructuring | Insights into the M&A process, including strategy, regulation, valuation, and shareholder engagement. |

| Private Equity | Understanding the private equity sector, including its growth and controversies. |

Current Class Profile

| Metric | Value |

| Class Size | 97 |

| International Students | 97% |

| Nationalities | 27 |

| Female Students | 47% |

| Average Age | 22 |

Careers

The MSc Financial Economics program boasts impressive career outcomes for its graduates.

| Metric | Value |

| Job Acceptance within 6 Months | 92% |

| Average Finance Salary | £66,761 |

| Reporting Rate | 92% |

| Number of Global Organizations Recruiting | 47 |

Salary Information by Sector

| Sector | Average Salary (£) | Min Salary (£) | Max Salary (£) |

| Finance | £66,761 | £21,261 | £111,842 |

Salary Information by Region

| Region | Average Salary (£) | Min Salary (£) | Max Salary (£) |

| Asia | £54,732 | £21,261 | £109,880 |

| Europe | £68,532 | £45,648 | £111,842 |

| Middle East and North Africa (MENA) | £59,621 | £31,613 | £74,087 |

| North America | £75,730 | £65,000 | £89,997 |

| United Kingdom | £58,905 | £35,000 | £77,500 |

Major Recruiters

| Employers |

| Bank of America |

| Bank of England |

| Citibank (APAC) Limited |

| Deutsche Bank |

| Goldman Sachs |

| Morgan Stanley |

| UBS |

Admissions

Application Process:

Applications for 2024 have now closed. Applications for 2025 will open in August 2024. The admissions process is staged, and only one application can be submitted per year.

Deadlines for 2024 Entry:

| Stage | Deadline |

| 1 | Friday 27 October 2023 |

| 2 | Friday 5 January 2024 |

| 3 | Wednesday 6 March 2024 |

Kira Talent Assessment Deadlines for 2024 Entry:

| Stage | Deadline |

| 1 | Friday 3 November 2023 |

| 2 | Friday 12 January 2024 |

| 3 | Wednesday 13 March 2024 |

Decisions for 2024 Entry:

| Stage | Decision Date |

| 1 | Friday 8 December 2023 |

| 2 | Wednesday 28 February 2024 |

| 3 | Wednesday 17 April 2024 |

Application Statistics:

| Metric | Value |

| Available Places | 84 |

| Average Applications (2021-2023) | 1,073 |

Fees and Funding

Course Fee for 2024-25: £55,630

This fee includes lifelong Oxford Union membership.

Deposit: £8,350

The deposit must be paid within 30 days of the initial offer letter.

Balance:

Tuition fees must be paid in full by the program start date in September.

Imperial College Business School

Imperial College Business School, nestled in the heart of London, offers a prestigious Master in Finance (MSc Finance) program designed to provide students with a comprehensive understanding of financial principles and practices. This article delves into the key features of the program, including its structure, class profile, admission requirements, and fees.

Program Details

- Start Date: 30 August 2024

- Duration: One year (full-time)

- Location: London, UK

Program Overview

The MSc Finance program at Imperial College Business School is a one-year, full-time intensive program designed for students seeking in-depth knowledge of finance in a global context. Key highlights of the program include:

- Class Schedule: Monday to Friday, with classes from 08:30 to 21:00.

- Curriculum: Core modules, electives, and optional activities such as guest lectures and career events.

- Professional Affiliation: As a member of the CFA University Affiliation Program, the curriculum is closely aligned with professional practice, aiding students in obtaining the Chartered Financial Analyst (CFA) designation.

- International Electives: Opportunities for students to broaden their perspectives through international electives.

Class Profile

The MSc Finance program at Imperial College Business School attracts a diverse cohort of students from around the world. The class profile for the program includes:

| Metric | Value |

| Number of Students | 86 |

| Average Age | 23 |

| Nationalities | 38 |

| Female Students (%) | 28% |

Degree Background

Students in the MSc Finance program come from various academic backgrounds, with the following distribution:

| Degree Background | Percentage |

| Economics | 41% |

| Business/Management | 18% |

| Finance/Accounting | 17% |

| Engineering/Technology | 13% |

| Mathematics | 9% |

| Arts/Humanities | 1% |

| Science/Medicine | 1% |

Employment Statistics (Class of 2022)

The employment statistics for the class of 2022 demonstrate the program’s success in preparing graduates for the finance industry:

- Employment Rate: 90% employed within three months

- UK Employment Rate: 82%

- Sector Distribution:

- Investment Banking: 48% (of those employed within finance)

- Average Salary: £49,000

Salary Distribution by Sector

| Sector | Salary (£) | Salary (PPP* £) | Salary (PPP* $) |

| Investment Banking | £56,195 | £57,563 | $85,406 |

| Consulting | £52,320 | – | $77,742 |

Admissions

Entry Requirements

- Academic Requirement: Preferably a First Class Honours degree or Upper Second Class Honours degree in a quantitative discipline.

- Prerequisite Knowledge: Proficiency in probability, calculus, matrix algebra, and real analysis.

- Internships and Work Experience: Strongly recommended to have relevant internships and work placements.

- English Language Requirement: Minimum IELTS score of 7.0 overall.

- GMAT or GRE: Recommended for candidates with less quantitative degree backgrounds.

Application Process

The application process for the MSc Finance program involves the following steps:

- Start your application online.

- Complete the application questions and submit supporting documents.

- Participate in a video interview or Skype/telephone interview.

- Receive the admissions decision and pay the deposit.

Fees

The tuition fees for the MSc Finance program for the academic year 2024 are as follows:

- Tuition Fee: £45,400

- Deposit: £4,540

IE Business School

IE Business School’s Master in Finance program is designed to provide students with a comprehensive and practical education in finance, preparing them for a successful career in various financial sectors. The program is tailored to fit individual career goals through multiple specialization tracks, offering a diverse and dynamic learning experience in a global setting.

Program Details

Duration: 1 year

Language: English

Location: Madrid

Intake: September & April

Format: Full-time

Professional Experience Range: 0-8 years

Average Age in the Classroom: 24

Number of Nationalities in Class: 31

Program Structure

The Master in Finance program is structured to provide a rigorous and thorough education in finance. The curriculum is divided into several phases, allowing students to specialize according to their career interests.

| Phase | Duration |

| Start Module | 2 weeks |

| Core Period | 8 months |

| Program Add-Ons | 1 week |

| Specialization Period | 2 months |

| Final Exam |

Specialization Tracks

Students can choose from four different tracks to tailor their studies:

- Investment Banking & Private Equity

- Global Markets & Asset Management

- Real Estate Finance & Alternative Investments

- Financial Analytics & Digital Finance

These tracks allow students to focus their financial knowledge and skills towards specific job roles and industry sectors.

Final Project

During the last months of the program, students work on a final project. Options for the final project include:

- Completing a CFA competition project

- Producing corporate valuation projects

- Executing a portfolio management practicum

- Carrying out a microfinance consulting project in Ghana

- Completing academic research

- Writing a case study

Careers

IE Business School’s Master in Finance graduates have a strong track record of securing employment soon after completing their studies.

Employment Statistics

| Metric | Percentage |

| Job Seekers Found a Job within 6 Months | 97% |

| Graduates Working in Finance Roles | 88% |

Employment Sectors

| Sector | Percentage |

| Financial Services | 71% |

| Consulting | 23% |

| Industrial | 4% |

| Consumer, Luxury & Retail | 1% |

| Technology | 1% |

Employment Functions

| Function | Percentage |

| Finance Roles | 88% |

| Consulting Roles | 5% |

| Data Related Roles | 3% |

| Engineering | 2% |

| Operations Roles | 1% |

| Sales Roles | 1% |

Admissions

The admissions process for the Master in Finance program is thorough and holistic, ensuring that only the most dynamic and creative candidates are selected.

Step 1: Online Application Form

Required Documents:

- Bachelor degree from an accredited university

- Official university transcripts (certified translation into English or Spanish)

- 1-page CV/Resume

- Contact information of two academic or professional references

- English language certificate (TOEFL, IELTS, Duolingo English Test, or Cambridge Advanced level)

- Photocopy of current passport

- Passport size picture

- Application fee: 150€ (non-refundable)

Step 2: Online Assessment

Candidates will answer three live questions (two in video format and one in written format) to allow the admissions team to evaluate their real-time response capabilities.

Step 3: Entrance Exam

Candidates must take one of the following exams: GRE, GMAT, GMAT Focus Edition, CFA level I, or CAIA level I. A competitive score is recommended, and waivers are available on a case-by-case basis.

Step 4: Personal Interview

Candidates will be interviewed (face-to-face or via Skype) by the Admissions Team or an IE Business School Finance Ambassador.

Step 5: Admissions Committee Final Decision

The final decision is made after a holistic evaluation of the entire application. It takes approximately 1-3 weeks for the committee to respond with a decision.

Fees

Tuition Fees for Upcoming Intakes: 41,000€

University of St. Gallen

The M.A. HSG in Banking and Finance (MBF) at the University of St. Gallen offers a comprehensive education in financial markets, financial institutions, corporate finance, and quantitative methods. This 1.5-year program is designed to prepare students for successful careers in a variety of finance-related sectors, including banking, consulting, insurance, and corporate finance, both in Switzerland and internationally.

Program Structure

Duration and Credits

- Duration: 1.5 years / 3 semesters (full-time)

- Credits: 90 ECTS

Curriculum

The MBF program ensures a solid foundation in the first semester through compulsory courses and allows for greater flexibility and customization in the second and third semesters.

| Semester | Courses |

| First | Compulsory Courses: Financial Markets, Financial Institutions, Quantitative Methods |

| Second | Core Electives and Contextual Courses |

| Third | Core Electives, Contextual Courses, and Master’s Thesis |

Compulsory Subjects (First Semester)

The first semester focuses on building foundational knowledge through three compulsory courses:

| Course | Description |

| Financial Markets | Fundamental principles and functioning of financial markets |

| Financial Institutions | Roles and operations of various financial institutions |

| Quantitative Methods | Essential quantitative techniques and their applications in finance |

Core Electives

Students can tailor their studies by choosing from a wide range of core electives in several focus areas:

| Focus Area | Course Examples |

| Financial Markets | Equity and Fixed Income Markets |

| Banking & the Financial Economy | Central Banking, Bank Management |

| Corporate Finance | Mergers & Acquisitions, Corporate Valuation |

| Alternative Investments | Hedge Funds, Private Equity |

| Risk Management & Insurance | Financial Risk Management, Insurance Markets |

| Quantitative Methods & Data Science | Financial Econometrics, Machine Learning in Finance |

Subject Tracks

To specialize further, students can focus on one subject track. A Diploma Supplement is awarded if at least 12 ECTS and the Master’s thesis are completed within the chosen track.

Career Opportunities

Graduates of the MBF program are highly sought after in various industries across Europe. Here is the breakdown of career paths pursued by MBF graduates:

| Industry | Percentage |

| Banking | 33% |

| Consulting | 24% |

| Asset Management | 18% |

| Corporations | 9% |

| Auditing/Advisory | 7% |

| Academia | 3% |

| Insurance | 2% |

| Fintech | 2% |

| Entrepreneurship | 1% |

| Public Financial Institutions | 1% |

Admissions

Eligibility Criteria

- Recognized Bachelor’s degree worth at least 180 ECTS credits in a relevant subject.

- Proficiency in English (C1 level recommended).

Selection Process

The selection process is conducted by the MBF Admission Committee across five admission rounds between October and April. The criteria for assessment include:

| Criteria | Weight |

| Average Grade during Undergraduate Studies | 30% |

| GMAT or GRE Score | 30% |

| Extracurricular Activities | 15% |

| Letter of Motivation | 25% |

Admission Rounds

| Admission Round | Application Deadline | Decision Date |

| First | 30 November 2023 | 22 December 2023 |

| Second | 31 January 2024 | 29 February 2024 |

| Third | 29 February 2024 | 31 March 2024 |

| Fourth | 31 March 2024 | 30 April 2024 |

| Fifth | 30 April 2024 | 31 May 2024 |

Application Requirements

Applicants must submit their applications online between 1 October and 30 April. The application fee is CHF 250. Required documents include:

- Digital passport photo

- Signed Enrolment Agreement

- Passport or ID card

- CV in English

- Supporting documents for extracurricular activities

- Letter of motivation in English

- GMAT or GRE test scores

- Higher education entrance qualification

- Degree documents and transcripts

Fees

| Category | Cost per Semester | Total Cost (3 Semesters) |

| Swiss Nationals | CHF 1,429 | CHF 4,287 |

| Foreign Nationals | CHF 3,329 | CHF 9,987 |

EDHEC Business School

The MSc in International Finance at EDHEC Business School is an advanced, comprehensive program designed to impart essential skills in corporate finance and financial markets. This program targets graduates and young professionals with prior training in numerous disciplines who aspire to careers in international finance. It equips students with the tools and knowledge to evaluate companies and investments, manage portfolios, and make strategic corporate finance decisions. Additionally, as a CFA Program Partner, it closely follows the CFA Level 1 exam curriculum, preparing students for this certification.

Key Details

| Program Name | MSc in International Finance |

| Start Date | Early September 2024 |

| Application Deadline | June 7, 2024 |

| Language | English |

| Campus | Nice |

| Duration | 1 year + 4-6 month internship/work placement |

| Accreditations | AACSB, CEFDG, EQUIS |

| Credit Value | 120 ECTS |

Curriculum

The MSc in International Finance program is structured into several key phases to provide a comprehensive education in finance.

Program Structure

| Phase | Period | Description |

| Foundation Courses | July-August | Online foundation courses to prepare students for the core modules. |

| Core Modules & Electives | September-February | In-depth classes on essential finance topics and electives for specialization. |

| Personalization Period | March-May | Customization of learning through electives and personal projects. |

| Internship or Employment | June onwards | Practical experience through internships or employment. |

Methodology

The program uses a blend of theoretical and practical learning approaches, including:

- Core Curriculum: Embracing latest technologies and market trends, co-developed with leading business partners.

- Blended Learning: Tutorials, lectures, workshops, and seminars.

- Applied Learning: Business games, case studies, and entrepreneurship projects.

- Personal Performance Coaching: Interviewing strategies, teamwork development, and intercultural communication skills.

Course Details

Foundation Courses

| Course Name | Description |

| Strategic Management | Online course on strategic business management. |

| Financial Analysis & Valuation | Online course on analyzing and valuing financial statements. |

| Corporate Finance & Asset Markets | Online course on corporate finance principles and asset market dynamics. |

| Introduction to Portfolio Construction & Analysis with Python | Offered by EDHEC Risk Climate Impact Institute via Coursera. |

Core Modules

| Course Name | Description |

| Corporate Finance | Advanced concepts in corporate finance. |

| Financial Accounting & Analysis | In-depth financial accounting techniques. |

| Advanced Valuation | Techniques for valuing companies and assets. |

| International Business | Focused on global business strategies (only for incoming students). |

| Portfolio Management | Principles of managing investment portfolios. |

| Empirical Methods in Finance | Research methods in financial studies. |

| Fixed Income & Derivatives Part 1 | Concepts in fixed income securities and derivatives. |

| Regulation & Ethics in Finance | Ethical and regulatory aspects of finance. |

| VBA Programming for Finance | Using VBA for financial modeling. |

| Leadership and Managerial Skills | Developing leadership and managerial competencies. |

| Research Methodology | Techniques for conducting financial research. |

| Python for Finance | Programming skills for financial applications. |

Career Prospects

Graduates of the MSc in International Finance from EDHEC are well-prepared for diverse roles in the finance sector, with impressive career statistics.

Employment Statistics

| Metric | Percentage |

| Jobs with International Dimension | 92% |

Employment Fields

| Field | Percentage |

| Wealth Management | 52% |

| Corporate Finance | 17% |

| Audit & Transaction Services | 14% |

| Risk Management & Other | 10% |

| Finance, FP&A, Accounting | 7% |

Key Recruiters

Top companies frequently hiring EDHEC graduates include:

- Barclays

- BlackRock

- Commerzbank

- EY

- Goldman Sachs

- JP Morgan

- KPMG

- Rothschild & Co

- Société Générale

- UBS

Admissions

Requirements

| Criteria | Details |

| Educational Background | Minimum 3-year bachelor degree. |

| English Proficiency | TOEFL ≥ 92, TOEIC ≥ 850, IELTS ≥ 6.5, Cambridge Test of English > 175. |

| Additional Tests | GMAT, GRE, TAGE MAGE, or CAT (optional but beneficial). CFA Level II holders get a GMAT waiver. |

| Application Documents | CV, Letter of motivation, Academic transcripts, Two letters of recommendation, Online interview. |

Admission Process

- Create an Account: Sign up on the EDHEC application portal.

- Submit Application: Complete the online form and upload necessary documents.

- Selection Committee Review: Applications are reviewed on a rolling basis.

- Interview: Eligible candidates are invited for an online interview.

- Final Decision: Applicants are informed of the decision via email.

- Application Deadline – June 7, 2024

Fees

| Description | Amount |

| Tuition Fees | €28,950 |

Fees Include

- Tuition fees

- Access to the EDHEC Career Centre

- Access to on-campus facilities

- Lifetime membership to EDHEC Alumni

- Administrative fees

SDA Bocconi

SDA Bocconi’s Master in Corporate Finance (MCF) program is a prestigious offering designed to equip students with specialized knowledge and skills in finance. Here, we delve into the details of this program, covering its structure, career prospects, admission requirements, and fees.

Program Details

- Next Start: 2 Oct 2024

- Duration: 12 Months

- Language: English

- Format: Full-Time

- Average Working Experience: 3 years

- Location: Milano

Program Structure

The MCF program is meticulously structured to provide comprehensive coverage of corporate finance topics, ensuring students are well-prepared for real-world financial tasks from day one.

XXV Edition 2024-2025

| Stage | Timeframe | Details |

| Online Tutorials & Pre-Courses | Sep 2024 – Oct 2024 | Preparation for in-class activities, covering Micro & Macro Economics and Accounting. |

| Fundamentals of Finance | Nov 2024 – Feb 2025 | Basic knowledge and skills in corporate finance, including financial economics, analysis, valuation, and capital markets. |

| Building and Financing Sustainable Growth | Feb 2025 – May 2025 | Advanced courses focusing on strategic areas of corporate finance. |

| Seminars | April 2025 | Applied Financial Modeling, Special Topics in Valuation, Financial Databases using Bloomberg. |

| Tracks | May 2025 – June 2025 | Specialization options include Corporate and Entrepreneurship Finance, Global Markets and Banking, Governance, Innovation & ESG Finance, and Fintech and Investment Management Solutions. |

| Individual Path to Success | July 2025 – Oct 2025 | Customizable options such as internships, research projects, or specialization tracks in New York and Mumbai. |

| Graduation Ceremony | Nov 2025 |

Careers

The MCF program at SDA Bocconi boasts impressive career outcomes, with a significant percentage of graduates securing employment shortly after graduation.

Latest Employment Statistics

| Metric | Percentage |

| Employed one year from Graduation | 70% |

| Time Spent to Find First Job after Graduation | |

| – While Studying | 70% |

| – Less than 3 Months after Graduation | 26% |

| – 3 to 6 Months after Graduation | 4% |

Job Function

| Function | Percentage |

| Corporate Finance | 38% |

| Investment Banking | 10% |

| Merger & Acquisition/Business Development | 10% |

| Business Intelligence | 7% |

| Administration & Controlling | 4% |

| Other | 28% |

| NA | 3% |

Job Sector

| Sector | Percentage |

| Financial Services (Banking, Insurance, Private equity) | 60% |

| Consulting | 14% |

| Industrial and Mechanical Products | 10% |

| Pharma, Biotech and Medical Devices | 7% |

| Food and Beverage | 3% |

| Automotive | 3% |

| NA | 3% |

Admissions

To be eligible for the MCF program, applicants must meet specific requirements and go through a thorough admission process.

Requirements

- University degree in any discipline

- Fluency in English

- GMAT/GRE or SDA test

- Interview with the program director

- Around 2 years of working experience

Application Deadlines and Fees

| Deadline Type | Date |

| Final Application Deadline | 26th June 2024 |

| Tuition Waivers Deadline | |

| – 1st Round | 11/12/2023 |

| – 2nd Round | 12/02/2024 |

| – 3rd Round | 19/04/2024 |

| – 4th Round | 26/06/2024 |

Admission Process

The admission process for the MCF program is meticulous, beginning well in advance of the program start date.

- Application Submission: Online application in English, reviewed on a rolling basis.

- Pre-Selection: Based on submitted documents, candidates are pre-selected for further evaluation.

- Interview: Conducted either at SDA Bocconi in Milan or remotely.

- Final Result: Formal letter of admission or placement on a waiting list.

Fees

The tuition fees for the MCF program are detailed below:

- Total Fee: €36,000 (to be paid in four installments)

- First Installment: €9,000 (on acceptance of admission offer)

- Second Installment: €9,000 (by 02 January 2025)

- Third Installment: €9,000 (by 28 February 2025)

- Fourth Installment: €9,000 (by 30 April 2025)

Final Thoughts

Choosing the right Master’s in Finance program is a critical decision for aspiring finance professionals. The programs at ESCP Business School, HEC Paris, Essec Business School, London Business School, IE Business School, University of St Gallen, Edhec Business School, University of Oxford: Saïd, SDA Bocconi/Università Bocconi, and Imperial College Business School stand out for their rigorous academics, international exposure, and strong career support. Graduates from these institutions are well-prepared to navigate and excel in the complex world of finance, equipped with the knowledge, skills, and network to reach the highest echelons of the industry. Whether you aim to become an investment banker, financial analyst, or corporate finance manager, these top programs provide the foundation and opportunities to achieve your career aspirations.